The most important reasons that people set up businesses are to make money and to improve their quality of life, and these should clearly be the things that the small business owner should concentrate on. There will come a time, however, when the small business owner is making profits and has established the working patterns to fit their lifestyles. At this point, it’s worth stepping back and thinking ‘what’s my business for?’

Ultimately, your business is there to protect you and your family, and the provide for your future.

Employers know that their employees are thinking about these things. How many times have you heard people say, ‘I can’t leave my job because the pension is so good!’?

Clearly, for the small business owner, they are the ’employer’ AND the ’employee’. Is now the time that they thought about providing themselves with their own ‘benefits-in-kind’?

Take a long hard look at your profits and your expenses. Is the business you run really providing you with all the benefits it could, and are you operating a profit first strategy? Don’t pay for that magazine subscription if the business isn’t funding your pension, don’t pay for that software subscription if the business doesn’t cover your medical insurance expenses, and don’t pay for that marketing service if the business isn’t buying you shares and building up your savings.

Here are some of the things your business could be providing for you:

Pensions

Firstly, it’s important to note that running a business is good for building up your State Pension benefits. If you pay National Insurance Contributions either through your Self Employment, or the pay you take out of your business, you will be accruing State Pension rights for your retirement.

But the State Pension age is going up and up, and that trend does not look like slowing down any time soon. Anyone else think that the State Pension age might go up to 75 (!), or even that it might be means tested? Who wants to work until they’re 75! If you don’t, and you like the idea that your pension assets might be your own, so that you can take them when you choose to, then funding your own pension is a good strategy.

Personal Pensions are easy to set up, and are an extremely tax efficient way of saving, regardless of whether you’re Self Employment or you run your business through a company. They also offer an opportunity to diversify your wealth away from your business and provide assets you can pass to your family if anything happens to you.

For these reasons, I think pension contributions are the first ‘benefit-in-kind’ a small business should fund.

Life Insurance

Everyone understands that they need to insure their car and insure their mortgage. What about protecting their family and making sure that if anything happened to them, their family would be alright.

Life insurance is cheap, and it can easily be set up. It can:

- be for a fixed term, for the whole or your life, or on a renewable basis

- be for a fixed amount of money, or for an increasing amount of money

- Pay a single sum on death, or pay a series of sums

- Provide personal protection or protect your business and/or business partners

- be cancelled at any time, if your requirements change

Not everyone needs life insurance, but if you have a family that you want to provide for, it’s always worth reviewing what would happen if you died, and making sure you’re covering any gaps.

Life insurance premiums are not usually deductible, but in some situations for small business owners might be. This is worth discussing with me if you’re interested.

Health Insurance

For most small business owners, not being able to work because of their health would be a catastrophic, because their business would not run without them. And with the current problems in the NHS not looking like they’ll be solved any time soon, do we really want to leave things to chance? Here are the sorts of protections your business can provide:

Private Medical Insurance

As well as medical treatment, most Private Medical Insurance (PMI) policies will cover private hospital accommodation and nursing care, as well as well as some level of cover for outpatient treatment (where you don’t stay in hospital overnight) and consultations. Extra cover that may be available can include:

- Psychiatric treatment

- Complementary therapies

- Drugs that aren’t available on the NHS (but that have been approved by the National Institute for Clinical Excellence)

Some PMI policies will provide lifestyle and activity tracking services. It might also provide access to health checks and medicals.

Again, if you value quick access to medical services, let me know if you’re interested.

Accident and Sickness Insurance

With simple and affordable Individual Protection cover, you can feel confident to live the life you love should life throw you off track through accident or illness. It will pay you benefits if you spend time in hospital or if you have an accident.

It will provide Worldwide financial support for you 24/7, covering a range of injuries from broken bones to those that could have a significant impact on your life. And with optional cover, you can protect your children and the activities you love as well.

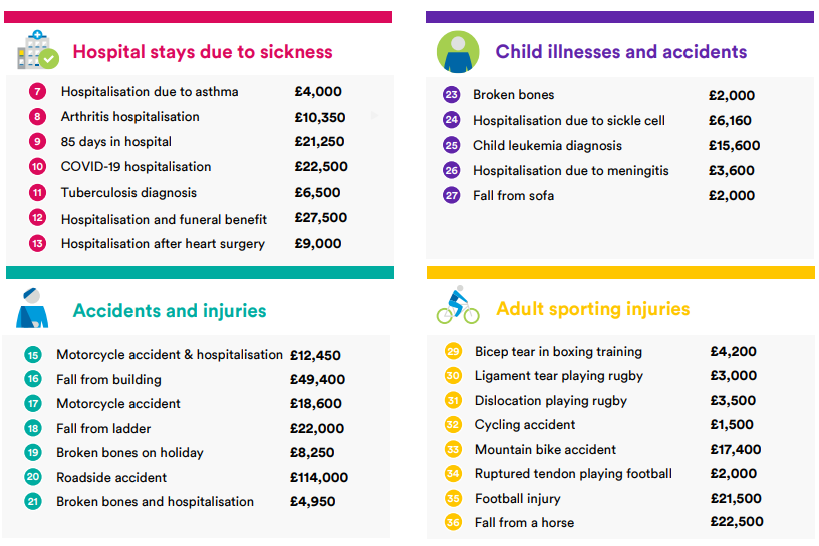

Here are some of the benefits that have been provided:

If this sounds interesting, let me know.

Critical Illness Insurance

Critical illness insurance provides you with a lump sum of money if you are diagnosed with certain illnesses or disabilities.

The kinds of illnesses that are covered are usually long-term and very serious conditions such as a heart attack or stroke, loss of arms or legs, or diseases like cancer, multiple sclerosis or Parkinson’s disease.

If being ill has left you out of pocket, it can be really handy to have a large sum of money to spend on things like everyday expenses, paying off your mortgage or your medical expenses. You can use the money in any way you like, you don’t have to spend it on anything in particular.

You may have other income coming in while you’re ill such as state benefits. However, this may not cover all your needs. It’s a good idea to think about how much you would need to live on if you became seriously ill and whether you would need some extra money to boost your income.

Income Protection

Income protection insurance pays you a regular income if you can’t work because of sickness or disability and continues until you return to paid work or you retire.

The amount of income you are allowed to claim will not replace the exact amount of money you were earning before you had to stop work. You can expect to receive about a half to two-thirds of your earnings before tax from your normal job. This is because some money will be taken off for the state benefits you can claim, and also the income you get from the policy is tax free.

You can’t claim income protection payments straightaway if you fall ill or become disabled. You usually have to wait a minimum of four weeks but payments can start up to two years after you stop work. This is because you may not need the money straightaway as you may get sick pay from your employer or you may be able to claim statutory sick pay for up to 28 weeks after you stop work.

If you’re worried about what might happen if you become ill and can’t work, income protection insurance could offer you and your family security.

Profit Sharing and ‘Share Options’

Saving money is important because it helps cushion the blow of financial emergencies and unexpected expenses. Additionally, saving money can help you pay for large purchases, avoid debt, reduce your financial stress, and provide you with a greater sense of financial freedom.

Saving money is important because it provides you with financial security. And the more you save, the more secure you will be.

Just as the most effective weight loss strategy is to limit portions by using smaller plates, by taking profit first and saving it and apportioning only what remains for expenses, entrepreneurs will transform their businesses from cash-eating monsters to profitable cash machines.

If this sounds interesting, let me know.

Holidays

Just because you are running your business on your own doesn’t mean that you shouldn’t take the same sort of annual leave that a regular employee would have. Taking a holiday every now and again can be beneficial for you and your business to prevent burn-out and provide incentives for all your hard work.

Everybody needs a holiday from time to time – don’t let the fact that the only person you really need to ask for permission to take one is you.

When you’re running your own business, the timing of your holidays can make all the difference. Try to choose a time that works best for your business and your clients to make sure you don’t miss out on too much work. If your clients have young families, it’s likely that they will be taking some time off during the summer holidays and things may quieten down around this period which may give you the perfect opportunity for you to get away. Similarly, most businesses close down for around two weeks over the Christmas period so this is another good time to get some guilt-free holiday time in.

Consider taking a holiday as a way of stepping back and taking a moment – you never know, you may even find some inspiration when you give yourself some space from the business. Give yourself the guilt-free permission to take a proper break from work and I’m confident that you’ll look back and be grateful that you were good to yourself.

Conclusion

Melior Wealth has many years’ experience providing practical financial planning advice to people, families and businesses. We provide advice across a wide range of services including savings, investments, and protection. We’re committed to putting clients at the heart of everything we do and to developing long-term relationships.

This is achieved by ensuring that they understand the individual needs of each client, and by implementing tailored financial plans to address those needs.

Let me know if I can help.